How to Apply for a Home Loan? | Complete Beginner’s Guide 2025

Owning a home is a dream for many, but with skyrocketing real estate prices, arranging the entire amount can be challenging.

This is where a home loan becomes a reliable financial partner.

If you’re wondering how to apply for a home loan, this simple and detailed guide will walk you through every step.

📚 Related Post: Top 10 Government Schemes for First-Time Home Buyers in India

1. Assess Your Home Loan Eligibility

Before applying, it’s important to check whether you meet the lender’s eligibility criteria.

Typically, banks look at:

-

Age (should be between 21-60 years)

-

Stable income source

-

Job/business stability

-

Healthy CIBIL score (preferably above 750)

-

Any outstanding debts or loans

✅ Pro Tip: Use a bank’s Home Loan Eligibility Calculator to quickly assess your chances.

2. Compare Different Lenders

Every lender offers different home loan products.

Before choosing one, compare factors such as:

-

Interest rates

-

Processing charges

-

Repayment flexibility

-

Hidden terms and conditions

Top Banks for Home Loans:

-

State Bank of India (SBI)

-

HDFC Bank

-

ICICI Bank

-

Axis Bank

✅ Pro Tip: Always weigh the benefits of fixed vs floating interest rates based on your financial goals.

📚 Related Post: Fixed vs Floating Interest Rate: Which is Better for Home Loans?

3. Gather Required Documents

Here’s a simple checklist of documents usually needed:

| Type of Document | Examples |

|---|---|

| Identity Proof | Aadhaar Card, Passport, PAN Card |

| Address Proof | Utility Bill, Rent Agreement |

| Income Proof | Salary slips, Form 16, ITRs |

| Bank Statements | Last 6 months’ records |

| Property Papers | Sale Deed, Property Tax Receipts |

✅ Pro Tip: Keep digital copies handy along with physical originals for a smoother process.

📚 Related Post: List of Important Documents You Need for Any Loan in India

4. Submit Your Home Loan Application

You can apply either:

-

By visiting the bank branch

-

Or online through the lender’s official website.

Fill out the application form, attach the documents, and pay the applicable processing fee (which usually ranges between 0.25%–1% of the loan amount).

5. Verification and Property Assessment

Once your application is submitted, the bank will:

-

Verify your personal and financial details

-

Conduct a technical inspection of the property

-

Perform a legal due diligence check

They will also pull your CIBIL report to review your creditworthiness.

📚 Related Post: How to Improve Your CIBIL Score Fast in 2025?

6. Loan Approval and Receiving the Sanction Letter

After successful verification, the lender will issue a Sanction Letter detailing:

-

Approved loan amount

-

Final interest rate

-

Loan tenure

-

EMI structure

✅ Important: Always read the terms and conditions carefully before signing.

7. Disbursement of Loan Amount

Once the agreement is signed:

-

The loan amount is either credited directly to the builder’s/seller’s account

-

Or transferred to your account (depending on the situation)

🏡 Congratulations — you now have the keys to your dream home!

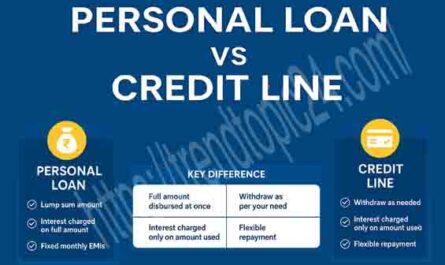

📚 Also Read: Personal Loan vs Credit Line: अचानक पैसों की जरूरत में कौन सा ऑप्शन है बेहतर?

📸 Home Loan Process Infographic

(Add an image with ALT Text: “Complete Home Loan Process in Hindi 2025”)

❓ Frequently Asked Questions (FAQ)

Q1. What is the ideal CIBIL score for a home loan?

A CIBIL score of 750 or above is considered excellent for faster loan approval at better rates.

Q2. Can I get a home loan with a poor CIBIL score?

Yes, it’s possible! You can:

Apply jointly with a co-applicant

Increase your down payment

Explore options with NBFCs (they may charge slightly higher interest rates)

Q3. Is prepaying a home loan allowed?

Absolutely. Most banks allow free prepayments on floating rate loans.

For fixed-rate loans, minimal charges might apply.

Q4. What are the tax benefits on a home loan?

You can claim deductions under:

Section 80C: Up to ₹1.5 lakh on principal repayment

Section 24(b): Up to ₹2 lakh on interest payments annually

Q5. What hidden costs should I be aware of?

Apart from EMIs, some additional charges may include:

Processing fee

Legal and technical evaluation fees

Stamp duty and property registration fees

Prepayment or foreclosure charges (in some cases)